Nvidia wants AI to Get Out of the Cloud and Into a Camera, Drone, or Other Gadget Near You - IEEE Spectrum

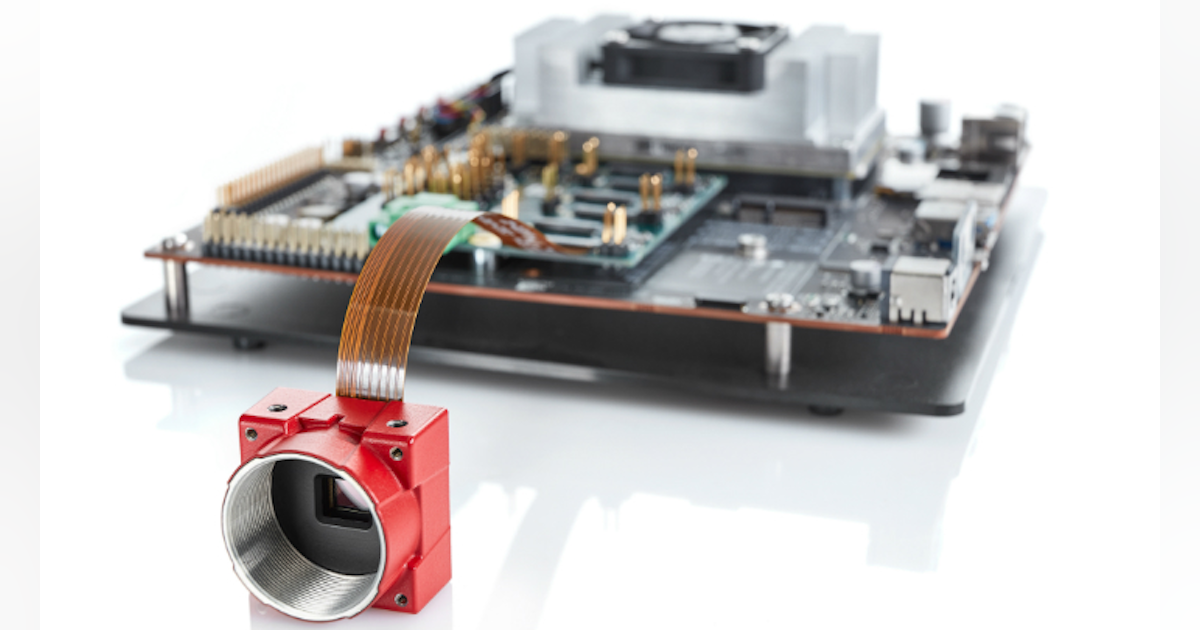

NVIDIA® Jetson™ TX2/Jetson™ Xavier NX-based Industrial AI Smart Camera for the Edge (NEON-2000 Series)

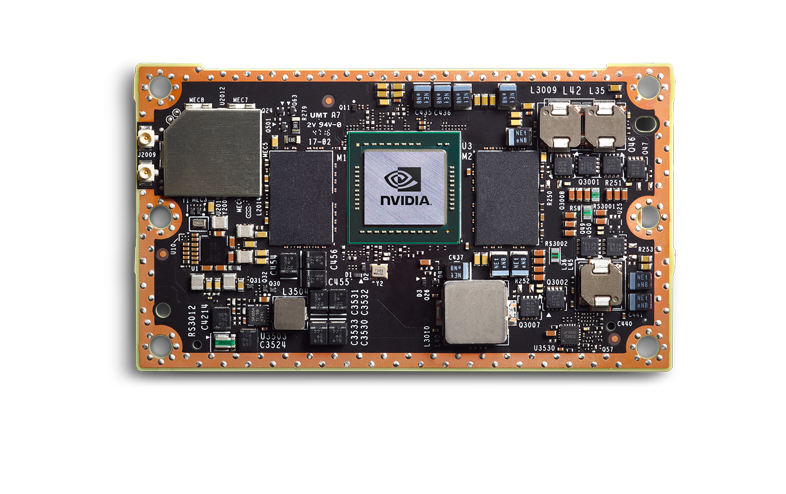

Jetson TX2 Based Platform - AN310-TX2 | NVIDIA Embedded Platform | Edge AI Computing Platform || Aetina Corporation

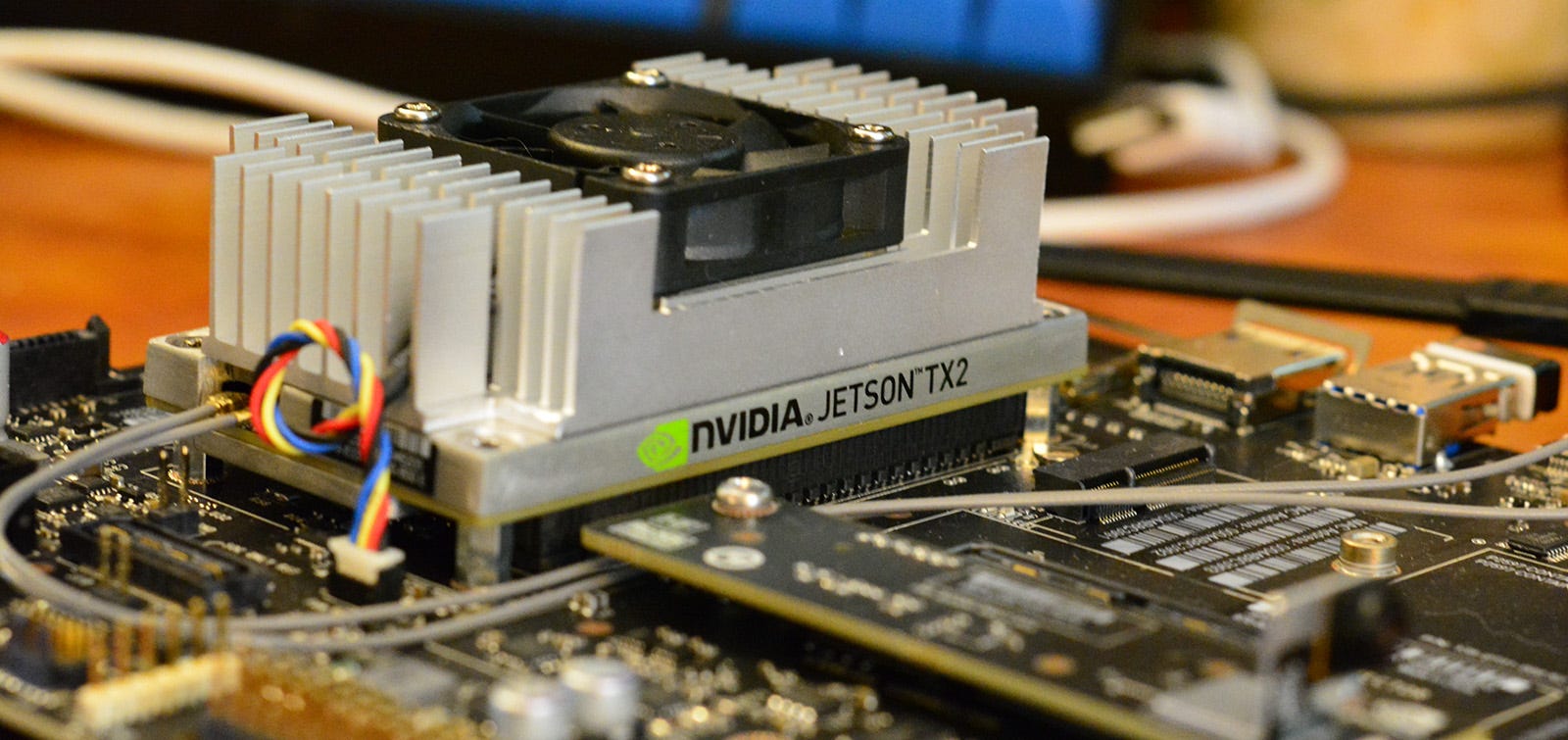

Nvidia TX2 Setting Board Kit AI Artificial Smart Nano Robot Car Setting Board Kit For Rc Smart Robot Car Accessories|Parts & Accessories| - AliExpress