Abstraktes Bild von verschiedenen Farben der Acrylfarbe gemischt Mit einer Technik zum Ausgießen von Farben Stockfotografie - Alamy

Mischende Säurehaltige Farben. Gesamtlänge Auf Lager. Helle Säurehaltige Tinte Von Verschiedenen Farben Werden Im Strom Auf Der Ob Stockbild - Bild von farben, mischen: 184626883

Abstraktes Bild von verschiedenen Farben der Acrylfarbe gemischt Mit einer Technik zum Ausgießen von Farben Stockfotografie - Alamy

Farbenfroher Künstlerischen Hintergrund, Mit Verschiedenen Farben Gemischt Mit Öl Und Milch Stockbild - Bild von hintergründe, farbe: 179708723

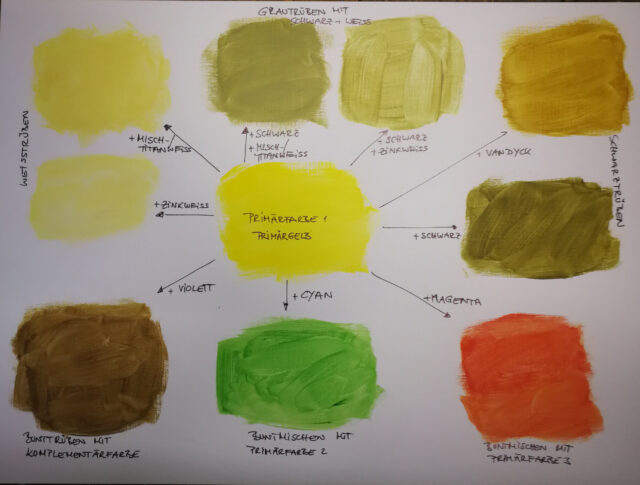

![Farben mischen – Die 30 besten Profi-Tipps [Ratgeber] Farben mischen – Die 30 besten Profi-Tipps [Ratgeber]](https://acrylgiessen.com/wp-content/uploads/2020/05/farben-mischen.jpg)