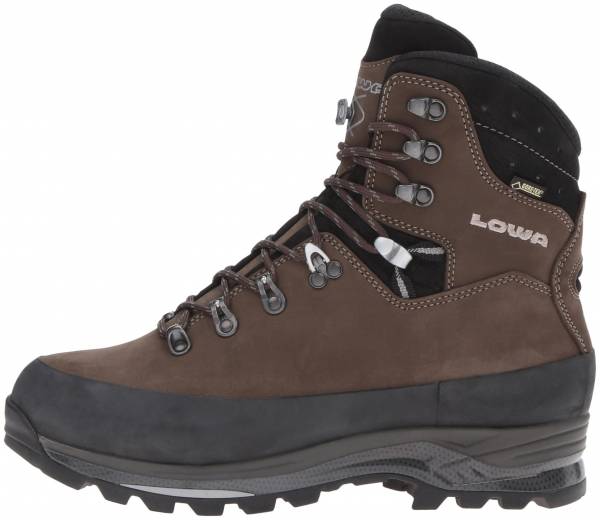

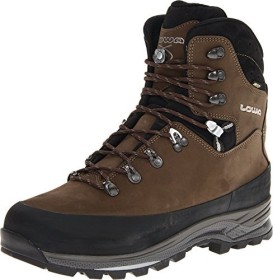

Lowa Tibet GTX sepia/black (men) (210680-5599) starting from £ 249.99 (2022) | Skinflint Price Comparison UK

Lowa Men's Tibet GTX Trekking Boot,Sepia/Black,9.5 M US- Buy Online in Dominica at dominica.desertcart.com. ProductId : 2915238.

Trekker Boots LOWA - Tibet Gtx GORE-TEX 210680 Sepia/Black 5599 - Trekker boots - High boots and others - Men's shoes | efootwear.eu